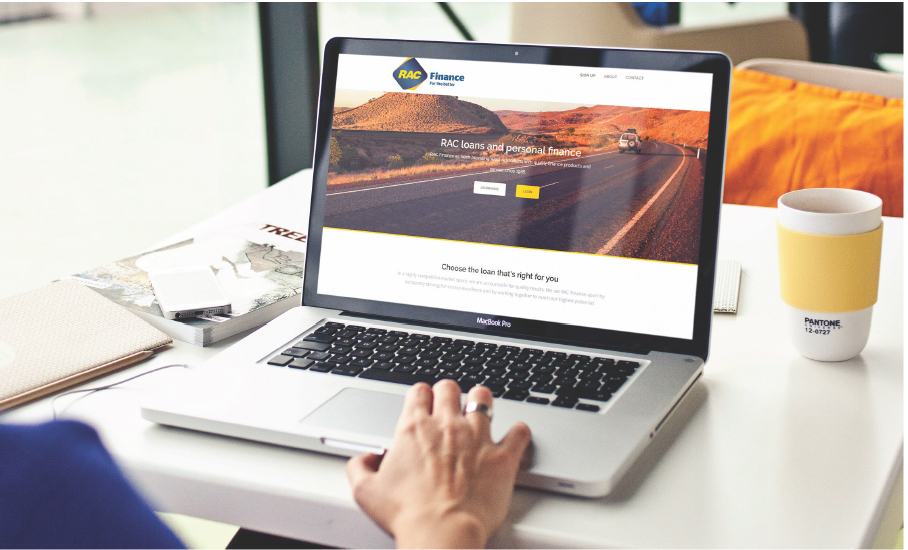

Digital solution for quoting and onboarding car loans. RAC is the automotive insurer for West Australian motorists. RAC Motoring was a long time client and had undergone a major redesign that I had led. As a result of this redesign, RAC Finance wished to align their brand to the new design and improve conversion from quotes to completed applications.

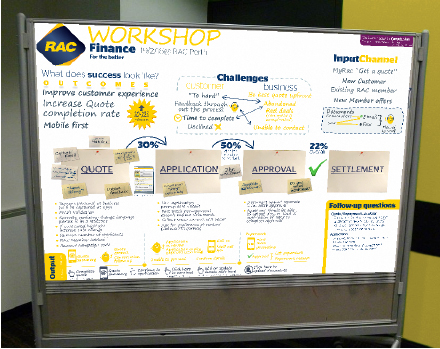

I undertook design workshops with the client defining what their needs were and developing an understanding of how they would fit in with Computershare (CCS) requirements. As RAC has an existing relationship with CCS I had a very good understanding of their brand so it was a matter of understanding the specific challenges RAC Finance were facing.

To achieve this I held workshops with a diverse selection of internal stakeholders to devise the customer journey maps that would be used as the basis for improving loan on- boarding.

By engaging stakeholders from across the business we received input from customer facing front line staff all the way to back of office finance. This allowed us to have a comprehensive understanding of the challenges faced by customers and the business alike. The outcome of the workshops was we had a clear problem statement to ease the on boarding experience for customers and a solid metric of success for the business. The follow up workshops focused on the internal challenges as well as addressing the customer journey, and customers perceptions and drivers. Once these had been established I created initial wire-frames and style tiles to create a shared understanding of workshop agreements.

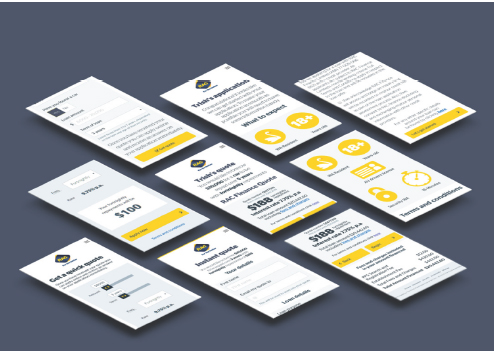

A mobile first approach along with desktop landing pages was chosen. Through rapid prototyping a demo was built and further iterations were created. RAC was pleased with how quickly we were able to iterate their feedback and how well the workshop process identified the clear areas they could improve the customer experience.